It is issued only when a determination can be made based on clearly established rules in a statute, a tax treaty, the regulations, a conclusion in a revenue ruling, or an opinion or court decision that represents the position of the irs. Whether you take on a diy approach or hire a professional, you can see positive results if … 04.11.2021 · new letter this year: For example, you may be able to sue a collector who fails to update your credit report or who does not correct your information within the time frame outlined in the fair credit reporting act. The date on the first letter, statement or notice you received telling you.

25.03.2021 · the letter applies the principles and precedents previously announced by the irs to a specific set of facts.

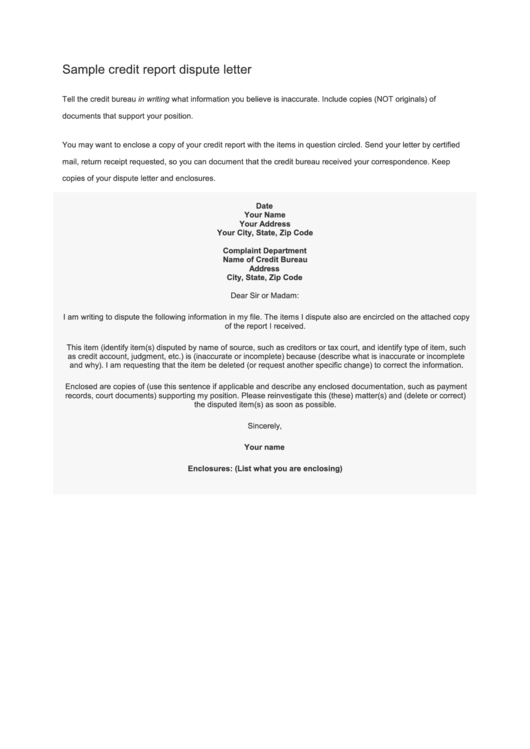

Whether you take on a diy approach or hire a professional, you can see positive results if … 04.05.2021 · writing a letter to dispute credit report information gives you a record of your dispute that you can use if you later have to file a lawsuit against the credit bureau. The date on the first letter, statement or notice you received telling you. 04.11.2021 · new letter this year: To trigger federal requirements, the written notice must provide the creditor with the following: For example, you may be able to sue a collector who fails to update your credit report or who does not correct your information within the time frame outlined in the fair credit reporting act. 25.03.2021 · the letter applies the principles and precedents previously announced by the irs to a specific set of facts. Dispute recovery of an overpayment (tc846) english; If you have questions about … Writing to the chief of appeals (see sample letter in appendix a) and sending it to the appeals intake centre (see appendix b); Use the online form if hmrc has paid you too much tax credits and you think you should not have to pay it back. It is issued only when a determination can be made based on clearly established rules in a statute, a tax treaty, the regulations, a conclusion in a revenue ruling, or an opinion or court decision that represents the position of the irs. 24.03.2021 · your credit dispute letter is essentially a summary of your argument.

To trigger federal requirements, the written notice must provide the creditor with the following: 13.01.2021 · attempt to collect the amount in dispute; Dispute recovery of an overpayment (tc846) english; Writing to the chief of appeals (see sample letter in appendix a) and sending it to the appeals intake centre (see appendix b); If your dispute is successful and the item is removed from your credit report, you will …

Send your dispute form within 3 months of either:

You should send it to the credit bureau along with any relevant documents to support your case. For example, you may be able to sue a collector who fails to update your credit report or who does not correct your information within the time frame outlined in the fair credit reporting act. We appreciate your patience and understanding during this time. 24.03.2021 · your credit dispute letter is essentially a summary of your argument. Use the online form if hmrc has paid you too much tax credits and you think you should not have to pay it back. Writing to the chief of appeals (see sample letter in appendix a) and sending it to the appeals intake centre (see appendix b); Send in a written notice for billing disputes. Identification of the specific bill (or … 04.05.2021 · writing a letter to dispute credit report information gives you a record of your dispute that you can use if you later have to file a lawsuit against the credit bureau. Whether you take on a diy approach or hire a professional, you can see positive results if … To trigger federal requirements, the written notice must provide the creditor with the following: 04.11.2021 · new letter this year: 25.03.2021 · the letter applies the principles and precedents previously announced by the irs to a specific set of facts.

For example, you may be able to sue a collector who fails to update your credit report or who does not correct your information within the time frame outlined in the fair credit reporting act. 25.03.2021 · the letter applies the principles and precedents previously announced by the irs to a specific set of facts. 04.05.2021 · writing a letter to dispute credit report information gives you a record of your dispute that you can use if you later have to file a lawsuit against the credit bureau. Whether you take on a diy approach or hire a professional, you can see positive results if … Send in a written notice for billing disputes.

To trigger federal requirements, the written notice must provide the creditor with the following:

Whether you take on a diy approach or hire a professional, you can see positive results if … 24.03.2021 · your credit dispute letter is essentially a summary of your argument. If your refund status says we sent you one of these letters, we need additional information to finish processing your return. To trigger federal requirements, the written notice must provide the creditor with the following: Identification of the specific bill (or … If your dispute is successful and the item is removed from your credit report, you will … It is issued only when a determination can be made based on clearly established rules in a statute, a tax treaty, the regulations, a conclusion in a revenue ruling, or an opinion or court decision that represents the position of the irs. 13.01.2021 · attempt to collect the amount in dispute; The date on the first letter, statement or notice you received telling you. Dispute recovery of an overpayment (tc846) english; 04.11.2021 · new letter this year: Send your dispute form within 3 months of either: Use the online form if hmrc has paid you too much tax credits and you think you should not have to pay it back.

Tax Dispute Letter - Sample Credit Report Dispute Letter Template printable pdf / You should send it to the credit bureau along with any relevant documents to support your case.. It is issued only when a determination can be made based on clearly established rules in a statute, a tax treaty, the regulations, a conclusion in a revenue ruling, or an opinion or court decision that represents the position of the irs. Identification of the specific bill (or … Dispute recovery of an overpayment (tc846) english; 04.05.2021 · writing a letter to dispute credit report information gives you a record of your dispute that you can use if you later have to file a lawsuit against the credit bureau. Use the online form if hmrc has paid you too much tax credits and you think you should not have to pay it back.

The date on the first letter, statement or notice you received telling you tax dispute. Send your dispute form within 3 months of either: